The Rapid Growth of the Medical Elastomer Market

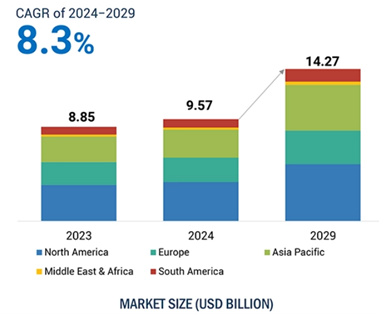

The global medical elastomer market reached $9.57 billion in 2024, and analysts expect it to grow to $14.27 billion by 2029, with an 8.3% CAGR.

The medical elastomer market is expanding rapidly as demand for advanced medical devices rises. These flexible, durable, and biocompatible materials, including tubing, catheters, syringes, gloves, and implants, are crucial in medical applications. As healthcare technology advances, the need for high-performance elastomers continues to grow.

You can also read: The Impact of PTFE in Medical

Regional Insights

The Asia-Pacific region is experiencing significant market growth due to an aging population, rising chronic disease cases, and expanding healthcare infrastructure. Hospitals and clinics are driving demand for medical elastomers, particularly in China and India, where healthcare investments are increasing.

Market size worldwide. Courtesy of Markets and Markets.

North America also holds a significant market share, as its healthcare system and leading medical device manufacturers drive growth. In the U.S., rising demand for medical products and services continues to increase, fueled by government programs that enhance healthcare access.

Challenges: High Production Costs

Two-roll mill processing. Courtesy of Nusil.

According to recent market reports, high manufacturing costs present a major challenge for the medical elastomer market. The complex manufacturing process requires stringent quality checks to ensure biocompatibility, durability, and resistance to sterilization, increasing overall production costs.

Applications such as implants and surgical gloves, demand advanced formulations that involve expensive additives and specialized processing. Material testing, certification, and compliance with regulatory standards like FDA requirements further add to expenses. Additionally, research and development investments in new elastomer formulations drive up costs.

These high costs make medical elastomers less accessible, particularly in lower-income developing countries with limited healthcare budgets. Market growth may slow down as manufacturers struggle to scale production and optimize economies of scale, impacting overall supply chain efficiency and market penetration.

Key Players and Developments

Leading companies such as BASF (Germany), Dow (US), Celanese Corporation (US), Eastman Chemical Company (US), and Syensqo (Belgium) are investing heavily in research and development. They continue to introduce innovative medical-grade elastomers to expand their market presence.

In January 2024, BASF opened its largest thermoplastic polyurethane production line at the Zhanjiang Verbund site in China to meet the rising demand for medical elastomers.

TPU plant at the Zhanjiang Verbund site. Courtesy of BASF.

As healthcare technology advances and expenditures rise, manufacturers continue to develop high-performance elastomers that comply with stringent regulatory standards, such as FDA and EU medical device certifications. Innovations in bio-based and recyclable elastomers are emerging, aiming to meet sustainability goals while maintaining product quality.

Manufacturers are integrating nanotechnology and smart polymers to revolutionize medical elastomers, improving their adaptability for specialized medical applications.

The growing demand for customized medical devices further drives research and development in elastomer formulations, ensuring enhanced patient comfort and device performance.