Dynamics in Polymer Production: U.S. and Middle East Perspectives

Shifting supply dynamics and evolving policies reshape the global polymer industry among changing investments and trade developments.

The polymer industry stands at a crossroads as regional supply chains shift, and resource availability fluctuates. The U.S., long a leader in polymer production due to its shale gas boom, now faces challenges as gas output declines. Meanwhile, the Middle East is rapidly expanding as a dominant global supplier.

As these regions navigate evolving economic and environmental landscapes, they reshape the global polymer industry in unprecedented ways.

You can also read: The UAE to Host the World’s Largest PLA Production Facility

U.S. Polymer Production: Riding the Shale Gas Wave

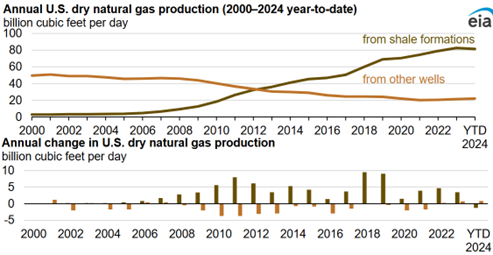

For years, the U.S. shale gas boom fueled a surge in ethane production, a critical feedstock for polyethylene (PE) and polypropylene (PP). However, according to the U.S. Energy Information Administration (EIA) report from 2024, U.S. shale gas output declined by 1% for the first time in decades. While current reserves cushion immediate impacts, continued reductions may force producers to explore alternative feedstocks like propane and naphtha.

Graphics Courtesy of U.S. Energy Information Administration, Short-Term Energy Outlook.

Despite supply concerns, U.S. polymer producers continue expanding export markets due to heavy investments by Dow, ExxonMobil, and LyondellBasell. However, as analysts forecast China’s ethane imports from the U.S. are set to surge over 20% in 2025, domestic feedstock supplies may tighten further, impacting price competitiveness in global polymer trade.

The Middle East: Cementing Its Polymer Production Status

On the other hand, the Middle East continues to strengthen its global influence through strategic acquisitions. According to the Wall Street Journal, Abu Dhabi National Oil Company (ADNOC) is finalizing a $13 billion takeover of Germany’s Covestro, reinforcing its dominance in polymer manufacturing.

Workforce and gender balance at ADNOC. Courtesy of ADNOC.

Meanwhile, Saudi Arabia, the UAE, and Qatar are ramping up polymer production, supported by vast petroleum reserves and government-backed investments.

The Evolving Landscape of Global Polymers

The U.S. and the Middle East are navigating distinct paths in the polymer industry. While the U.S. faces supply adjustments and evolving regulations, the Middle East is leveraging its resource availability and strategic investments to expand its market presence.

As China increases its reliance on U.S. ethane imports, trade relationships, and price dynamics will continue to shift, potentially influencing global production costs and investment strategies.

As estimated by Grand View Research, 2024, The Middle East polymer market is projected to reach $80.1 billion by 2030, growing at an annual rate of 4.2%, while the U.S. polymer market is expected to reach $119.2 billion by 2030, with an annual growth rate of 3.8%. How these regions adapt to shifting dynamics will shape the future of the global polymer industry in the coming years.