Vietnam – U.S. Plastics Trade: A Strategic Shift in Global Supply Chains

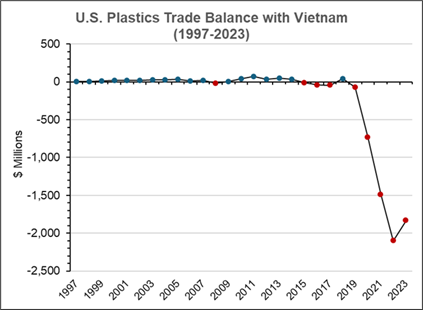

Once a surplus trade partner to the U.S., Vietnam has transitioned into a deficit position as its imports of American plastic products overgrow.

The evolution of Vietnam’s role in the U.S. plastics trade highlights significant shifts in global supply chains and trade dynamics. Initially a surplus trade partner with the U.S., Vietnam has increasingly become a vital player, transitioning to a deficit position as its imports of U.S. plastics products surge.

You can also read: Europe’s Plastics Industry in 2023

This transformation reflects broader economic and industrial trends that will shape the future of this relationship.

Changing Patterns in Plastics Trade

Historically, Vietnam was a source of low-cost, finished plastic goods. However, its imports of raw plastics and semi-finished goods from the U.S. have increased substantially. This shift indicates Vietnam’s growing manufacturing capabilities and integration into global production networks, particularly in electronics, automotive, and consumer goods sectors.

U.S. Plastics Trade Balance with Vietnam (in Millions of Dollars, 1997-2023). Years reflecting a trade deficit are red. Taken from 2023 Plastics Global Trends Report.

According to recent data from the Plastics Industry Association, the U.S. has become a significant supplier of resin and other raw plastic materials to Vietnam. The expansion of Southeast Asian countries’ industrial bases and efforts to meet both domestic and export-oriented demand drive this trend. Vietnam’s economic goals of advancing up the value chain and reducing its reliance on low-margin manufacturing align with this development.

Factors Shaping the Future

The restructuring of global supply chains, a process hastened by geopolitical tensions and the disruptions of the COVID-19 pandemic, has established Vietnam as a significant alternative manufacturing hub to China. This shift positions Vietnam to become increasingly reliant on U.S. plastic resins and semi-processed materials as businesses seek diversified and stable sources for their inputs.

Environmental and sustainability considerations are also critical. As global concerns over the environmental impact of plastics increase, Vietnam is implementing stricter regulations while committing to international climate goals. Consequently, these regulatory changes could influence the types of plastics Vietnam imports, shifting demand toward recyclable and biodegradable materials. Moreover, this transition creates opportunities for the U.S. to export environmentally friendly materials tailored to meet Vietnam’s evolving sustainability requirements.

Technological advancements in plastics production and recycling will play a pivotal role in redefining trade patterns. Vietnam’s investment in advanced manufacturing technologies and processing capabilities could enable it to emerge as a hub for high-value plastic goods. Such advancements could also help balance its trade relationship with the U.S. by increasing the export of finished products.

Opportunities and Challenges

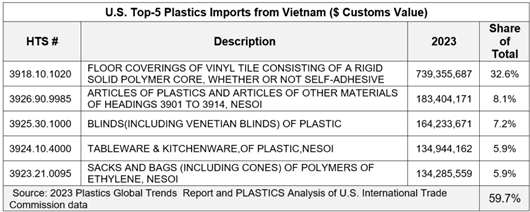

The future of the U.S.-Vietnam plastics trade offers both opportunities and challenges. For U.S. exporters, Vietnam represents a burgeoning market for raw materials, particularly given its strategic location in Asia and its role in regional supply chains. However, competition from other suppliers, including China and other ASEAN nations, remains a challenge. Additionally, navigating Vietnam’s regulatory landscape will be crucial for sustained market access.

Vietnam’s top five plastic exports accounted for nearly 60% of U.S. imports in 2023, highlighting their critical role in meeting U.S. demands. Taken from 2023 Plastics Global Trends Report.

For Vietnam, the growing imports from the U.S. present an opportunity to strengthen its manufacturing ecosystem. Yet, achieving this requires investments in technology, infrastructure, and workforce development to fully capitalize on its potential.