Key Players Shaping the Future of Plastics

In 2024, leading players in the plastics industry actively shaped the market through strategic actions, including significant mergers, acquisitions, and innovations that drive market transformation.

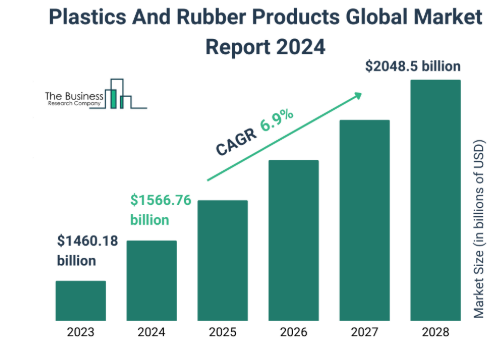

The plastics and rubber sectors, valued at $1.6 trillion, are witnessing strategic mergers as major players consolidate their positions. Additionally, companies like Amcor, Berry Global, Borealis, and Covestro leverage high-impact deals to drive innovation and adopt advanced technologies. Furthermore, these bold strategies align with the increasing global demand for sustainable solutions. This reflects a market shift toward operational efficiency and responsibility.

You can also read: Berry’s New PE Cling Film Targets PVC Food Packaging.

Driving Adoption and Addressing Sustainability Challenges

The plastics industry has experienced significant growth due to replacing traditional materials like glass, metals, and wood with plastics across various sectors, including packaging, automotive, and construction. Plastics’ versatility, lightweight nature, and cost-effectiveness contribute to their widespread adoption.

However, this widespread adoption has led to significant environmental challenges, particularly concerning plastic waste and its management. Moreover, traditional plastic waste management strategies, such as landfilling and mechanical recycling, must be revised to address the growing scale of plastic pollution.

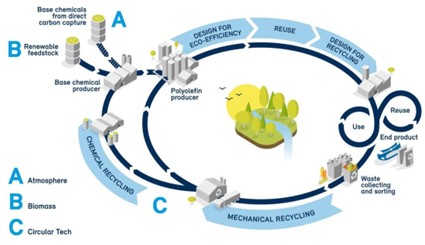

In response to these challenges, there is a growing emphasis on developing recyclable and biodegradable plastics and advancing recycling technologies to support a circular economy.

Total market size of rubber and plastics industry. Taken from thebusinessresearchcompany.com

Strategic Mergers Driving Transformation in the Industry

Building on the drive for sustainability and innovation, key players in the industry are leveraging strategic mergers and acquisitions to address market demands and regulatory challenges. These moves not only consolidate market leadership but also accelerate advancements in recycling technologies and sustainable materials.

One of the most significant moves this year is Amcor’s acquisition of Berry Global in a $8.4 billion all-stock deal. This merger positions the combined entity as the world’s largest plastic packaging company, solidifying their market leadership. Berry Global, based in Indiana, contributes its expertise in flexible packaging and a strong global presence, while Amcor adds its innovative edge in advanced packaging solutions. Together, the companies aim to achieve substantial cost efficiencies and advance their sustainable packaging initiatives.

Innovative Recycling Companies

Likewise, Vienna-based Borealis AG, a polyolefins leader, has expanded its recycling portfolio through strategic acquisitions of innovative recycling companies. For example, its acquisition of Rialti S.p.A., a major producer of recycled polypropylene compounds, highlights Borealis’s dedication to sustainability and innovation. Furthermore, Borealis acquired Integra Plastics AD, a Bulgarian mechanical recycling pioneer, to enhance its capabilities in advanced plastic waste recycling. These strategic moves align with Borealis’s strong commitment to advancing the circular economy and promoting environmentally responsible manufacturing practices globally. Additionally, Borealis’s joint venture, Borouge, supports this mission by significantly expanding its global manufacturing capabilities in the recycling sector.

Borealis strengthens its Circular Cascade Model strategy through strategic acquisitions. Courtesy of borealisgroup.com

In another high-profile development, Abu Dhabi’s Adnoc (Abu Dhabi National Oil Company) is in advanced negotiations to acquire German chemical giant Covestro for an equity value of approximately €11.7 billion. This acquisition reflects Adnoc’s strategic shift toward sustainable technologies and high-performance materials, which are integral to Covestro’s offerings. If finalized, this deal would signify a major industry shift, combining Adnoc’s extensive resources with Covestro’s expertise in advanced chemical solutions.

These mergers and acquisitions highlight a broader trend of consolidation in the plastics sector. As companies respond to regulatory pressures, volatile raw material costs, and rising demand for sustainable materials, they are not only expanding market share but also securing leadership in recycling technologies and bioplastics innovation. These strategic moves are reshaping the industry, positioning key players to meet evolving global demands.