Industry Drivers for Coatings in Plastic Packaging

The plastics industry is transforming under sustainability demands, with coatings driving growth through recyclable mono-material solutions replacing multilayer packaging.

According to the Global Chemicals, Materials & Nutrition Research Team at Frost & Sullivan, as outlined in their report, “Growth Opportunities in the Glass, Plastic, and Paper Packaging Coatings Industry,” factors such as a projected 70% increase in global food production by 2050, the aging population’s growing pharmaceutical needs, and the rapid expansion of personal care markets fuels the demand for advanced coating technologies.

You can also read: Proprietary Taggant Systems: Empowering Plastics Security.

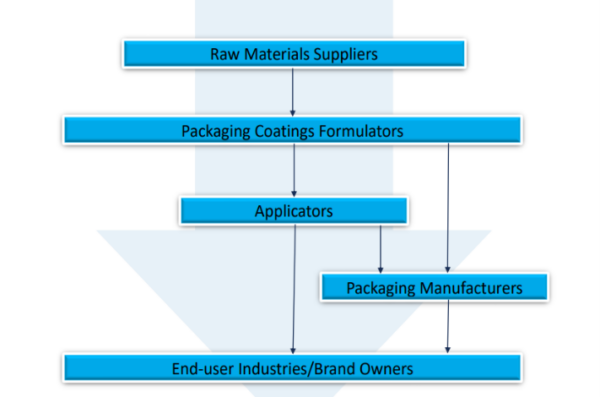

Understanding the Plastic Packaging Coatings Value Chain

The plastic packaging coatings value chain integrates raw material suppliers, formulators, applicators, manufacturers, and end-users to deliver high-performance, sustainable solutions.

Suppliers provide raw materials, which formulators convert into specialized coatings for barrier protection and adhesion. Applicators ensure precise application, manufacturers integrate coatings into packaging, and end-users define standards to meet regulatory, brand, and sustainability goals.

Value chain of packaging coatings. Taken from Frost & Sullivan report.

Competitive Landscape and Innovations

The global plastic packaging coatings industry, with fewer than one hundred key players, thrives on intense competition shaped by price, performance, regulatory compliance, sustainability, and innovation. Leading companies, including PPG Industries, Sherwin-Williams, and Axalta Coating Systems, dominate this dynamic market alongside significant participants such as BASF SE and Henkel.

In response to evolving consumer preferences and stricter regulatory demands, manufacturers actively develop advanced coatings like acrylics, epoxies, and polyurethanes. These innovations improve barrier properties, enhance recyclability, and boost aesthetic appeal, effectively addressing the growing emphasis on sustainability and eco-friendly solutions.

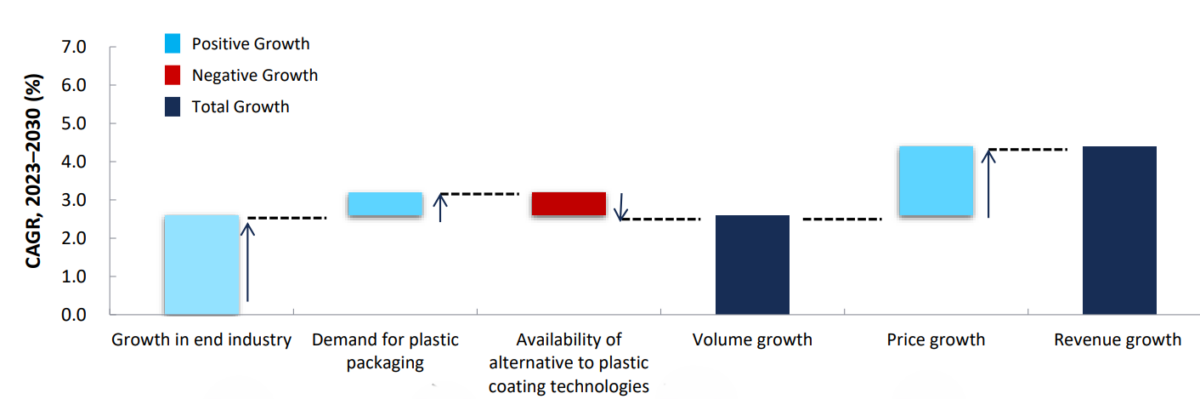

Growth Drivers and Restraints in Plastic Packaging Coatings

Advancements in recyclable mono-material solutions primarily drive growth in the plastic packaging coatings market by replacing multilayer packaging with eco-friendly alternatives. These innovations simplify complex multi-layered structures while meeting sustainability standards. However, the market faces restraints as brands increasingly adopt sustainable materials like metal and paper, reducing their reliance on plastic. Furthermore, the trend toward smaller, convenience-focused packaging decreases coating volume demand, particularly in the medical and food sectors. Despite these challenges, industry adaptations and shifting consumer behavior will moderate their impact, enabling a balance between innovation and sustainability.

Market Forecast for Plastic Packaging Coatings

The global plastic packaging coatings market will grow at a 4.4% CAGR from 2023 to 2030, reaching $4.07 billion. Emerging markets in Asia-Pacific and MEA will drive growth with rising demand for advanced coatings, while developed regions like North America and Western Europe may see slower growth as brands shift to alternative materials.

Plastic Packaging Coatings: Summary of Growth Drivers and Restraints, Global, 2023–2030. Taken from Frost & Sullivan report.

Polyvinylidene di-chloride (PVdC) will remain the leading barrier coating technology, while aluminum oxide (AlOx) and silicon oxide (SiOx) will see robust growth due to their superior barrier properties and ability to reduce plastic usage. Antimicrobial coatings will remain vital, with North America leading the market, followed by APAC and Europe.

As sustainability pressures rise, advancements in recyclable materials and recycling infrastructure will shape the future of plastic packaging coatings.

Read the full report here: Growth Opportunities in the Glass, Plastic, and Paper Packaging Coatings Industry.