Teknor Apex Adds TPVs With High Recycled Content

Automotive grades meet growing sustainability needs of OEMs and brand owners

First of a two-part report.

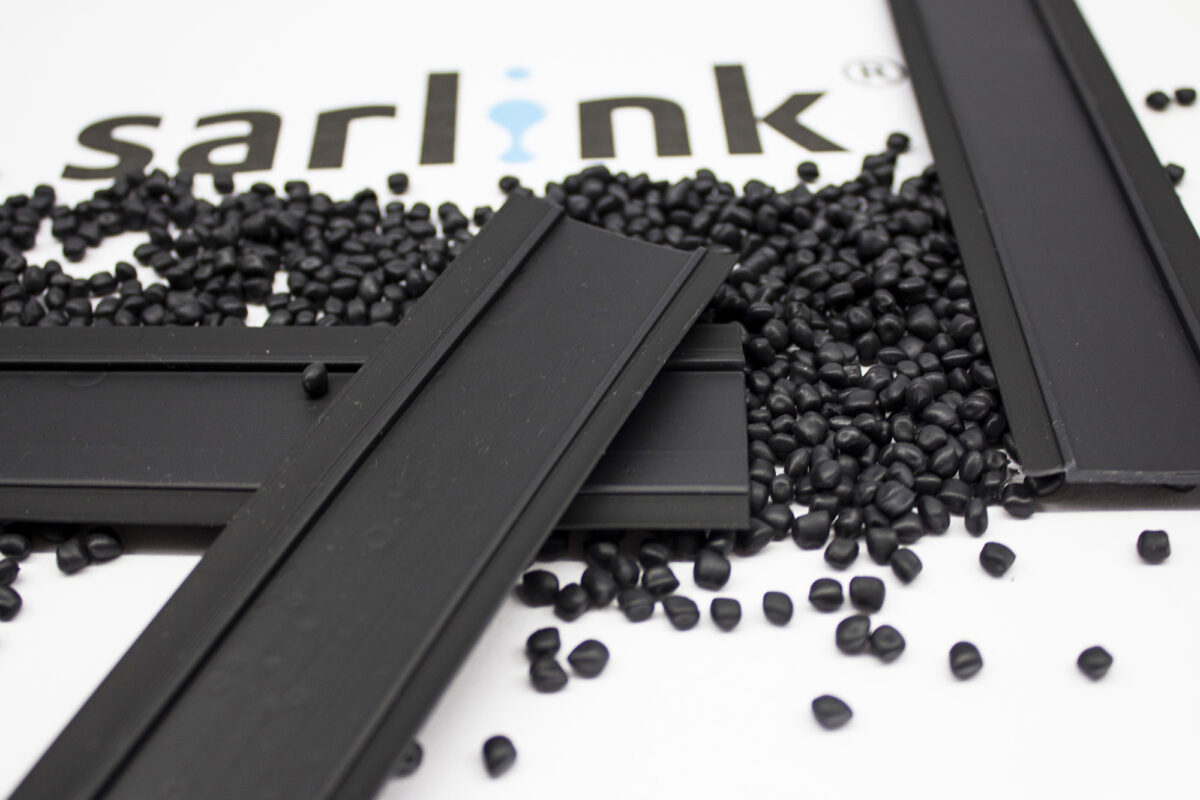

The announcement that Teknor Apex has commercialized two grades of Sarlink thermoplastic vulcanizate (TPV) elastomers containing hefty proportions of recycled plastics demonstrates how rapidly this approach to sustainability is evolving.

The global compounder, based in Pawtucket, R.I., recently added the SRX 3100B series of workhorse TPVs for automotive to the Sarlink line. This includes an 84 Shore A grade with 25 percent post-industrial recyclate (PIR) and a 94 Shore A version with 40 percent PIR.

Recycled Content Increases in New Grades

The PIR loadings reflect the growing proportions of recycled content that suppliers are adding to their grades, all for sustainability. Where suppliers once blended 10 to 20 percent loadings of recyclate with prime resins to meet green product needs, some formulate grades with 50 percent or more post-use material. (See Aug. 17 report about compounder Polymer Resources Ltd.)

“Consumers are driving [high loadings of recyclate in products] through OEMs and brands,” says Jonathan Plisco, commercial co-founder, innovation team at Teknor Apex. “In the case of TPVs, this is what the auto industry is reaching for. They have made powerful claims for sustainability in products. One way to make this happen is with materials, the greatest part of a product’s LCA (life cycle analysis). They’re forcing this upstream on companies like Teknor Apex,” he adds. “It’s coming down to their purchasing and engineering organizations to make this happen. There’s been a great meeting of the minds [between us]. We can do it, so why not?”

The use of PIR gives Teknor Apex more control over the quality of recyclate it sources than if post-consumer recyclate was used. Nevertheless, Plisco says it was difficult to set up a supply chain especially as the PIR had to meet established Sarlink properties in formulations.

Recycled Content Meets Provides High Properties

“The recyclate has to have the same properties, and we have to make sure we had enough supply,” he remarks. “We have contracts in place in the U.S. and Europe [for supply]. It wasn’t easy—it took a year-and-a-half to vet suppliers and scale up trials, though we’d done similar work in SEBS (styrene-ethylene-butylene-styrene) compounds and TPS (thermoplastic styrenic) elastomers.”

Plisco notes, however, “We had to really think this through: we have a brand to support and can’t compromise [on performance]. The grades must be cost-effective for buyers and have parity in properties and cost [with other Sarlink TPVs].”

When asked how the 3100B compounds compare in performance and cost with virgin Sarlink grades, Scott Nakon, global automotive market manager, replies, “We are not giving up performance. The specs all revolve around performance. We matched up [with] our 3100 series.”

The cost of the new grades “is at par or a slight premium [over conventional TPVs],” he says. “A lot of buyers think they’ll get a deal with recycled content. But it’s not like that with these grades. In Europe, some OEMs need to be provided with a sustainable grade as well as a prime grade to evaluate” per European Union regulations. “These rules will be coming our way eventually,” Nakon adds.

Production of the SRX 3100B grades is scaling up. The TPVs are replacements for EPDM parts, Nakon says. “Our target is sealing systems, the backbone carriers for lip seals.” Teknor Apex supplies Sarlink 3180 grades with 90 Shore A hardness for this application, and Nakon thinks the new materials can take more market share. He’s also looking at CV drive axle boots and bellows as candidate parts and at coolant line applications, a new market.

New TPVs Will Help Expand Automotive Market

He expects that the TPVs will broaden the company’s automotive market share, including from cannibalization of parts made with Teknor Apex materials. Might this be a problem? Not really, he responds. “Cannibalization is in many ways growing our markets because it opens applications we weren’t getting before.

“Our goal is to bring in higher-end materials, with higher levels of temperature and chemical resistance,” Nakon says. “This will open the way to companies we haven’t worked with. TPVs are a mature business but there are opportunities.”

One benefit of the TPVs over EPDM is end-of-life recyclability. “The end-of-life product has a better footprint—and there’s less energy needed to produce the part” than with EPDM, which is a plus for manufacturing and for sustainability.

In our next report, we’ll discuss plans by Teknor Apex to introduce an elastomer for consumer products with 65 percent recycled content.